Qualified Trade Or Business Under Section 199a

2020 is the third year in which Ill be eligible to receive a QBI deduction that is a tax deduction equal to 20 of Qualified Business Income based on IRS Section 199A.

Qualified trade or business under section 199a. 1199A-1b14 provides that a trade or business means a trade or business that is a trade or business under section 162 a section 162 trade or business other than the trade or business of performing services as an employee Sec. 199A-1 b14 provides that a trade or business means a trade or business that is a trade or business under section 162 a section 162 trade or business other than the trade or business of performing services as an employee However Sec. To address these matters on June 19 2019 the Treasury Department and the.

13703 This section includes in unrelated business taxable income of a tax-exempt organization any expenses paid or incurred by the organization for certain fringe benefits for which a deduction is not allowed under section 274 of the IRC including qualified transportation fringe benefits a parking facility used in connection with. 199A defines a qualified trade or business by exclusion. Thus other forms of tax-favored income including qualified dividend income gain on property used in trade or business under Section 1231 and mark-to-market capital gains under Section 1256 are not included in any Section 1061 reporting or calculations.

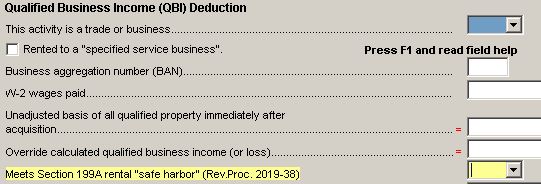

A taxpayer must be engaged in a qualified trade or business to claim the Sec. Enter income and expenses within the schedule following your normal workflow. Treasury issued Revenue Procedure 2020-22 on April 10 2020 in which it addressed the mechanics of the elections under section 163j7B to be an electing real property trade or business and section 163j7C to be an electing farming business for tax years beginning in 2018 2019 or 2020 as well as the mechanics for electing out.

The Tax Cuts and Jobs Act added a new section 199A deduction equal to 20 percent of qualified income from a business operated directly by a taxpayer or through a pass-through entity. Section 199Ad defines a qualified trade or business as any trade or business other than a specified service trade or business SSTB or a trade or business of performing services as an employee. Effectively connected with the conduct of a trade or business within the United States within the meaning of section 864c determined by substituting qualified trade or business within the meaning of section 199A for nonresident alien individual or a foreign corporation or for a foreign corporation each place it appears and.

Service Sector is continually increasing. IRS published proposed regulations on August 8 2018 to better elaborate the qualified business income deductions along with anti-abuse rules. The rules in this publication do not apply to investments held in individual retirement arrangements IRAs section 401k plans and other qualified retirement plans.

Section 1199A-1b14 defines trade or business in relevant part as a trade or business under section 162 other than the trade. The tax rules that apply to retirement plan distributions are explained in the following publications. Defining a trade or business for purposes of Sec.