Nonprofit Unrelated Business Income

Serious issues would likely exist under the unrelated business income rules for an organization with more than 50 of its total gross income produced from unrelated business activity.

Nonprofit unrelated business income. Unrelated Business Income Tax UBIT in the US. There are exceptions to this exception. Choose an available business name that meets the requirements of state law.

A nonprofit organization NPO also known as a non-business entity not-for-profit organization or nonprofit institution is a legal entity organized and operated for a collective public or social benefit in contrast with an entity that operates as a business aiming to generate a profit for its owners. Internal Revenue Code is the tax on unrelated business income which comes from an activity engaged in by a tax-exempt 26 USCA 501 organization that is not related to the tax-exempt purpose of that organization. For example if nonprofit.

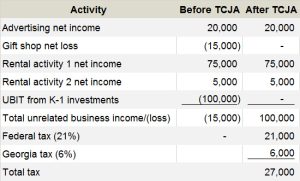

Any revenues that exceed. Passive income such as interest dividends rents and royalties is also generally excluded from unrelated business income Serious issues would likely exist under the unrelated business income rules for an organization with over 50 of its total gross income produced from unrelated business activity as that would be more than insubstantial. In order to maintain their tax status this money must come from activities related to the organizations mission.

Passive income such as interest dividends rents and royalties are generally excluded from unrelated business income. Nonprofit Application for Sales Tax Exemption. The IRS differentiates your organizations income into two categories.

Furthermore Section 27B of the Tax Code imposes on proprietary educational institutions and hospitals which are not-for-profit a 10 percent tax on their taxable income except passive sources of income with the further limitation that if the gross income from unrelated trade business or other activity exceeds 50 percent of the total. Forming a nonprofit corporation is much like creating a regular corporation except that nonprofits have to take the extra steps of applying for tax-exempt status with the IRS and their state tax divisionHere is what you need to do. Taxation of Unrelated Business Income Fundraising.

Unrelated business income for a tax exempt organization refer to the Internal Revenue Service Publication 598 Tax On Unrelated Business Income Of Exempt Organizations. Indiana Nonprofit Organization Unrelated Business Income Tax Return. However if it earns a profit by renting its building for unrelated events that profit is taxable as normal business income.